SLIDE 1 OF 16

Managing your lifestyle is all about making smart choices. Each lifestyle decision you make, from your choice of a home, to what you drive, to how you spend your leisure time, has an impact on your overall financial situation. We’ll take a look at how smart strategies can enhance your lifestyle while at the same time potentially freeing up assets to invest for the long term.

SLIDE 2 OF 16

As we approach lifestyle choices, it is useful to take a look at Maslow’s famous “hierarchy of needs” diagram. In his landmark 1943 study, Maslow placed lifestyle choices on an ascending scale of importance—from basic needs to peak experiences—that bring emotional satisfaction.

Approaching our lifestyle choices in this way can help us separate our needs from our wants.

After the basic needs of food and water comes the category of shelter. Our home represents one of our basic needs, and the type of home we choose also potentially fills other needs higher up on the pyramid, such as self-actualization.

Source: Abraham H. Maslow, “A Hierarchy of Needs,” Psychological Review, 1943

SLIDE 3 OF 16

If you own a home, making good choices with your mortgage is critical.

One of the first considerations is whether to take out a 15- or 30-year mortgage. A 15-year mortgage is structured to pay off your loan quicker, but the payments are likely to be higher. A 15-year mortgage also means you’ll pay less in interest over the life of the loan. If you can afford higher payments, it may be worth considering.

You also may have a choice between a fixed- or variable-interest-rate loan.

If you select a fixed-rate mortgage, you’ll lock in a specific interest rate for the life of the loan. If you select a variable-rate mortgage, the interest rate may fluctuate based on a financial index. As the index adjusts higher or lower, your monthly payment may change.

Which mortgage approach makes the most financial sense?

Largely, the answer is going to depend on your individual situation. Some people want to aggressively pay down their loan, so a 15-year mortgage may make the most sense. Some people prefer to lock in on a mortgage payment, so a fixed-rate loan is the more appropriate approach. Our firm suggests you consider understanding the pros and cons of all mortgage loans as you evaluate different choices.

SLIDE 4 OF 16

Just for fun, let’s take a look at the highest priced home listed on Zillow today.

This home is on Bel Air Road in Los Angeles, California. It hit the market in 2018 for $188 million. But what would it really cost to own? We’ll use this extreme example to illustrate the real cost of home ownership.

Let’s start with the mortgage. Let’s say that you put a 20% down payment on a $188 million home. With a hypothetical 4.75% interest rate on a 30-year fixed mortgage, the payments would be $785,000 per month, $9.4 million per year—that’s roughly 154 times the national median income. This would result in about $132 million going toward interest over the duration of the mortgage.

If we estimate another hypothetical 1.25% of the price of the house for taxes, and 1% for insurance and upkeep, we can estimate that this house will cost more than $13 million per year to own and maintain.

A $9.4 million monthly mortgage and $13 million annual cost are outrageous; but the principle remains the same. Every asset has an opportunity cost: what the money may have earned elsewhere.

Sources: Zillow.com, November 26, 2018; Census.gov, 2018

SLIDE 5 OF 16

The home is not only a significant asset, it represents a significant part of our lifestyle.

Where and how we live is meaningful on many different levels. Our homes are reflections of who we are, and so the decision of how much home we want—or need—may vary with each situation; it is not strictly a financial decision.

However, the financial component of the decision should be considered thoughtfully.

For example, the cost of maintaining a large home might be put toward activities that better fit your desired lifestyle, such a travel and hobbies. Others may find that a large home still meets their needs.

The days when we could expect our homes to steadily increase in value may be behind us. So a decision about housing has grown more complicated.

SLIDE 6 OF 16

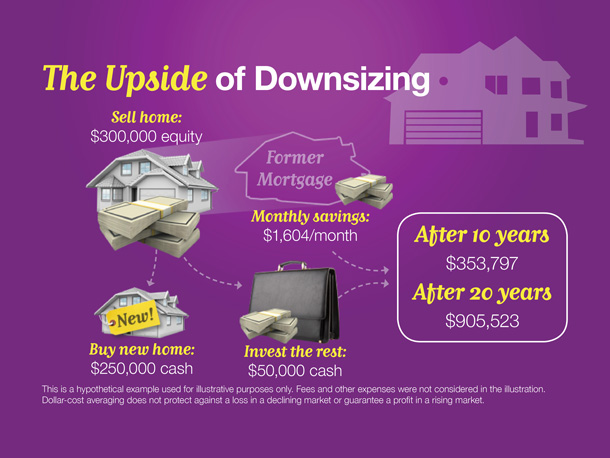

Let’s follow a couple through the lifestyle choice of home ownership.

In this case study, Ron and Cindy own a $500,000 house. They’re both turning 55, and since their children are no longer living at home, they’ve decided to downsize their home. Since their equity in the home is $300,000, they’ve decided to pay cash for the new home. No more mortgage payments.

Here’s one of the keys to their decision: they’ve decided to put the extra $50,000 into an investment, which they anticipate may earn a hypothetical 6% rate of return. In addition, each month, Ron and Cindy intend to invest the money they save on a mortgage payment—$1,604 a month—in the same investment, taking advantage of dollar-cost averaging.

If the investment has a hypothetical 6% average annual rate of return, after 20 years their balance could be expected to grow to more than $900,000.

Keep in mind that dollar-cost averaging does not protect against a loss in a declining market or guarantee a profit in a rising market. Dollar-cost averaging is the process of investing a fixed amount of money in an investment vehicle at regular intervals, usually monthly, for an extended period of time, regardless of price. Investors should evaluate their financial ability to continue making purchases through periods of declining and rising prices.

The hypothetical investment results are for illustrative purposes only and should not be deemed a representation of past or future results. Actual investment results will vary. This does not represent any specific product and/or service.

SLIDE 7 OF 16

According to the National Association of Home Builders, the average home size in America stands at 2,641 square feet.

Here are some guidelines for being smart about home ownership.

First, find the best mortgage structure for you. Consider your tax bracket, your income sources, and your time horizon. Structure a payment schedule that works for you.

Second, reassess your home regularly to ensure that it continues to meet your needs.

Finally, consider “right-sizing“ your home if you find that the costs outweigh the satisfaction.

Source: National Association of Home Builders, May 21, 2018

SLIDE 8 OF 16

The next category of consideration in lifestyle choices is luxury items and leisure activities.

In other words: what you buy and what you do.

SLIDE 9 OF 16

The line between necessity and luxury has shifted.

We tend to categorize as necessities many things that our parents either never heard of or lived without.

The list of necessities vs. luxuries may be different for each person, but it is important to remember that each luxury item we buy or leisure activity we pursue has two costs: the actual costs in dollars and the opportunity cost—what the money may have earned elsewhere.

Let’s examine one item many people dream of owning: the luxury car.

SLIDE 10 OF 16

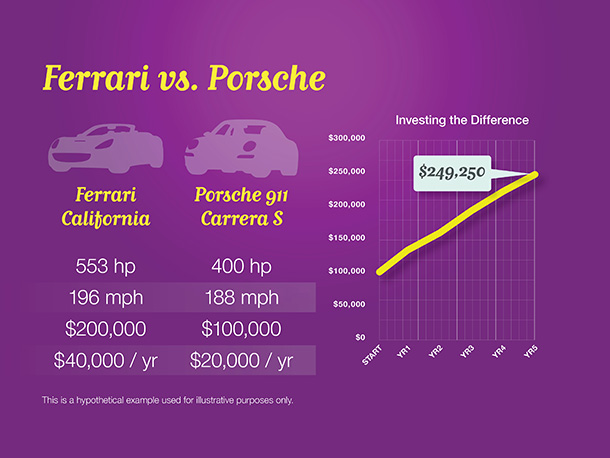

Since we’re aiming high, let’s buy a Ferrari.

A new Ferrari California has 553 horsepower and has a published top speed of 196 miles per hour. It costs about $200,000. But that’s not the entire story. If we estimate taxes, insurance, and maintenance at a hypothetical 20% of the purchase price, keeping that Ferrari on the road may cost another $40,000 a year.

A new Porsche 911 Carrera S only has 400 horsepower and has a published top speed of 188 miles per hour. The Porsche costs $100,000. Using the same hypothetical 20% figure as before, the Porsche may cost $20,000 a year in taxes, insurance, and maintenance.

Say we were to invest the difference in the purchase price—$100,000—in an investment with a hypothetical 6% average annual rate of return. In addition, we invested the $20,000 in maintenance saved each year in the same account. After five years, the hypothetical account would be expected to grow to nearly $250,000.

Luxury items—such as the sports car of which you’ve always dreamed—may be an important part of your lifestyle. As in any other financial decision, however, that luxury sports car or sailboat has an opportunity cost: what the money may have earned elsewhere.

The hypothetical investment results are for illustrative purposes only and should not be deemed a representation of past or future results. Actual investment results will vary. This does not represent any specific product and/or service.

SLIDE 11 OF 16

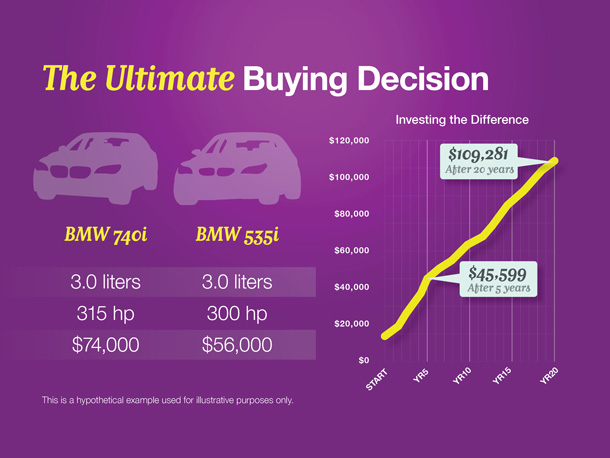

Let’s revisit our case study with Ron and Cindy. They have decided to purchase a BMW and they are evaluating whether to purchase a 740i, which has a retail sticker price of $82,000, and a 535i, which has a sticker price of roughly $51,000.

After running the numbers, they opted for the 535i.

The difference in purchase price was $31,000. Ron and Cindy decided to invest the $31,000 into an investment which they anticipate may earn a hypothetical 6% rate of return. In addition, for the first five years, they have decided to invest the money they would have otherwise spent in additional taxes, fuel, and insurance on the more expensive car into the same investment.

If the investment has a hypothetical 6% average annual rate of return, after five years their balance could be expected to grow to nearly $75,000—enough to potentially buy another 535i. After 20 years, their account could potentially be worth $109,281.

Ron and Cindy understood the opportunity cost of the 740i.

The hypothetical investment results are for illustrative purposes only and should not be deemed a representation of past or future results. Actual investment results will vary. This does not represent any specific product and/or service.

SLIDE 12 OF 16

Leisure activities can add meaning and variety to your lifestyle.

Some consumers are rethinking their leisure options, however. Instead of the luxury hotel room at a resort, many are choosing different options, such as renting a privately owned home or condo.

Rather than owning a second home, some prefer to opt in for shared ownership. Money that is saved by making smart leisure decisions can be used for investment.

Let’s take one final look at our case-study couple, Ron and Cindy.

SLIDE 13 OF 16

Cindy and Ron take a two-week vacation every year. Traditionally, they’ve stayed at expensive hotels and just figured the money spent enhanced their lifestyles.

Now Cindy and Ron have decided to rethink their leisure options—to get the same experience at a lower cost.

They’re replacing the $400-per-night hotel with a condo rented through a private owner, for a savings of $200 per night. That amounts to a savings of $2,800 per year.

Staying in the condo may also allow them to prepare a few of their own meals, cutting food expenditures. Watching for deals on flights and using miles has the potential to reduce the cost of airline tickets. Combined, less expensive meals and airline tickets are expected to save $2,000 per year.

The difference in vacation costs is $4,800 a year. Ron and Cindy decided to invest the $4,800 into an investment, which they anticipate may earn a hypothetical 6% rate of return. If Ron and Cindy make the same decisions for 20 years—with an anticipated savings of $4,800 a year deposited each year into the same investment—the account would be expected to have a balance of more than $175,000 by the end of 20 years.

The hypothetical investment results are for illustrative purposes only and should not be deemed a representation of past or future results. Actual investment results will vary. This does not represent any specific product and/or service.

SLIDE 14 OF 16

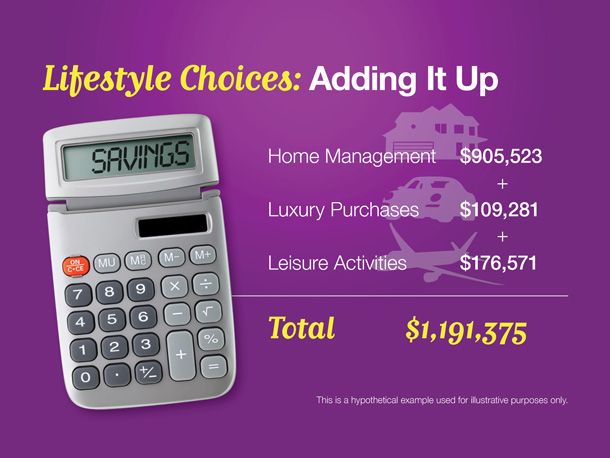

Let’s take a look at the cumulative effect of these smart lifestyle choices by Cindy and Ron.

By downsizing their home and investing their mortgage savings, they could accumulate a potential $905,523 over the 20 years.

By driving a less-expensive version of their dream cars and investing the difference, they could accumulate a potential $109,281 over 20 years.

Finally, by making smart vacation choices, they might save $4,800 per year on their vacations, which could accumulate a potential $176,571 over 20 years.

Smart decisions can add up over time.

SLIDE 15 OF 16

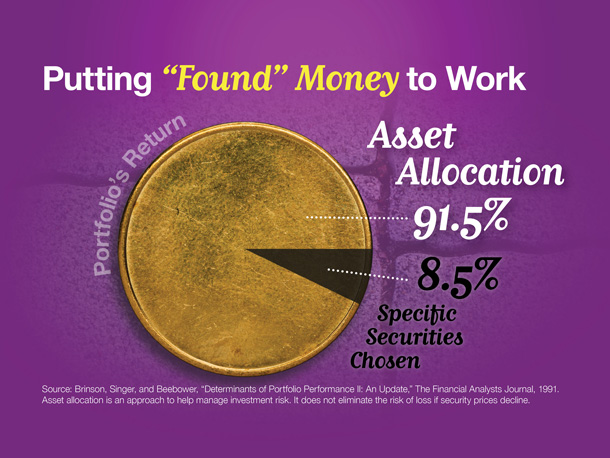

Our case-study couple Ron and Cindy have pursued ideas that have the potential to save them money year after year. When reviewing investment choices, they have learned about how asset allocation works.

Asset allocation is an approach to manage investment risk by diversifying a portfolio among major asset classes, such as stocks, bonds, and cash equivalents. Stocks, bonds, and cash alternatives have different levels of risk and potential return. Over any period of time, one asset class may be increasing in value while another may be falling. Both asset allocation and diversification are approaches to help manage investment risk. But they do not guarantee against investment loss.

A now-classic landmark study showed that up to 91.5% of the performance of the average portfolio is determined by how the assets within that portfolio are allocated between different investment classes. Only 8.5% has to do with the specific securities chosen.

Source: Brinson, Singer, and Beebower, “Determinants of Portfolio Performance II: An Update,“ The Financial Analysts Journal, 1991

SLIDE 16 OF 16

Effectively managing your lifestyle can lead to an increase in resources as you grow older—while still allowing you the enjoyment of some of those resources now. And you will have the satisfaction of knowing that you are a smart lifestyle manager.

Here are some questions that arise at different stages of life:

Anthony and Selena have a growing family and wonder, “Will it make more sense to choose a 15- or a 30-year mortgage?”

Dave and Christine are in retirement. They ask, “Does it make sense to downsize our house now that the children are grown?”

Rebecca is a single woman with a small business. She wants to know, “What lifestyle changes can I make to set aside more for investment?”

Isaac likes to do research online. He asks, “What’s the best place to invest the money I’m freeing up?”

The answers to these and other concerns will vary with each individual situation and can all be addressed in a review.