LifeBright is here to help you

Move your Financial life Forward.

Most younger professionals are focused the next 3-5 years of life. From deciding what “extra’s” you can afford today, to making decisions about how to invest in your 401(K) plan, starting an IRA to planning a wedding, starting a family or wondering if you are saving enough for your future or for unexpected emergencies, there’s a lot to consider.

Living in the moment and preparing for tomorrow are not mutually exclusive ideas. “Living” takes time, energy and money, both today and for future wants/needs.

What your future looks like depends on choices you make today. We will help you understand your options and make correct decisions, so you can relax and feel confident that today is taken care of, and your tomorrow looks bright.

High account fees and large minimum investment requirements put good advice out of reach for those that want to start planning and investing early in life.

We make planning and investing easy, affordable and efficient.

Because most financial advisors require an investment between $250,000 and $1,000,000. they generally work with people that are affluent, just on the cusp of retirement, or already retired. Advisors charge a fee to manage this money, generally between 1% – 2% of the account value(s) per year. Or, they are paid by selling overly expensive and restrictive insurance products.

While there is certainly a need for prudent investment, tax, and estate planning in these later years, these are people who’s wealth is a product of decisions they made earlier in life, for better or worse.

Making sound financial decisions today is even more important. “Time” can be your biggest ally, or your worst enemy when it comes to managing your finances. The sooner you start, the less you have to save.

Making correct decisions early in life can allow for greater latitude in how you live today, and still be comfortable tomorrow. This is what we do!

Time is money!

Not starting early is poor decision #1 that most people make.

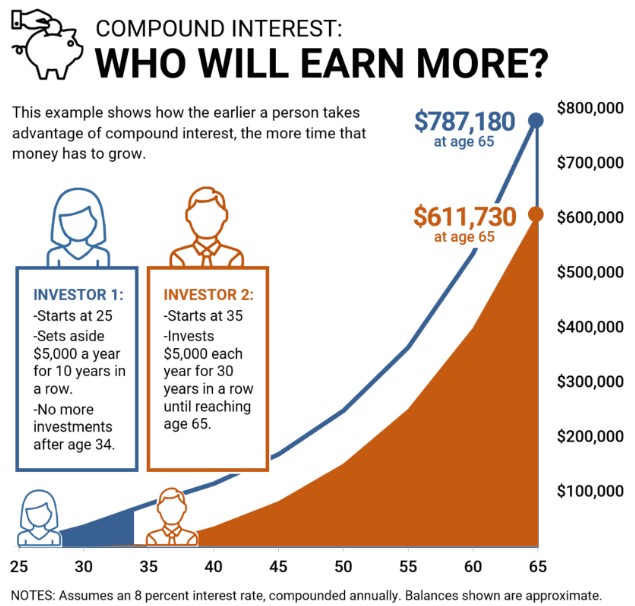

As you can see, starting to save early makes all the difference.

Investor #1 saves $50,000 over 10 years.

Investor #2 saves $150,000 over 30 years.

Why the big difference in account balances at age 65? Time! Compound interest is a powerful factor in building wealth over time. In this example investor #2 saves three times as much as investor #1, and still has less money at retirement. Let your money do the hard work for you. Helping people live life today while looking to the future is what we do.

Let us put our experience of over 30 years to work for you!

Questions about our planning process and how it can help you?